Certifications

We have obtained certifications from Dun & Bradstreet, CNAS, and other verification,

showing that our service and quality testing meet international standards

News More >

From Prototyping to Production: Optimizing Through-Hole Resistor Footprints

Introduction to Through-Hole ResistorsThrough hole resistors have been fundamental components in electronic circuits for decades. They are known for their durability and ease of use, making them a staple in both prototyping and production environments. These resistors are inserted into pre-drilled holes on a printed circuit board (PCB) and soldered onto the opposite side, providing a strong mechanical bond. Despite the rise of Surface Mount Technology (SMT), through-hole resistors remain relevant, particularly in applications where high reliability and mechanical stress resistance are crucial.Understanding the Standard Resistor FootprintIn PCB design, a "footprint" refers to the layout on the PCB where a component, such as a through-hole resistor, is mounted. This layout includes the pads, holes, and spacing required to accommodate the component. The footprint must match the physical dimensions of the resistor to ensure proper fit and functionality. Standard footprints for through-hole resistors typically include dimensions for lead spacing (the distance between the resistor's leads), pad size, and hole diameter. Common sizes range from 200 mils (5.08 mm) to 400 mils (10.16 mm), depending on the resistor's power rating and application.Importance of Footprint Accuracy in PCB DesignAccurate resistor footprints are critical in PCB design for several reasons. First, they ensure that the component fits correctly during assembly, preventing issues like misalignment or improper soldering. Second, accurate footprints contribute to the overall reliability and performance of the electronic device by ensuring consistent electrical connections. Common mistakes in footprint design include incorrect lead spacing, insufficient pad sizes, or improper hole diameters, all of which can lead to manufacturing defects or component failure. Designers can avoid these errors by adhering to standard guidelines and verifying footprints using PCB design software.Comparing Through-Hole and Surface Mount Resistor FootprintsThrough-hole and surface-mount resistors serve similar purposes but differ significantly in their footprints and applications. Through-hole resistors typically offer better mechanical strength, making them ideal for high-reliability applications, such as industrial electronics. Their footprints, however, require more space on the PCB, which can limit design flexibility. On the other hand, SMT resistors have smaller footprints, allowing for more compact and higher-density designs. However, they are generally less durable under mechanical stress and may not be suitable for high-power applications.Designing Custom Footprints for Non-Standard ResistorsIn some cases, designers may need to create custom footprints for non-standard or unique through-hole resistors. This process involves using PCB design software to define the exact dimensions of the component's leads, pads, and holes. When designing custom footprints, it is essential to consider factors such as lead spacing, pad size, and the thermal properties of the resistor. Verifying these custom footprints with a prototype board is also recommended to ensure proper fit and function before committing to mass production.Common Applications of Through-Hole ResistorsThrough-hole resistors are often preferred in applications where reliability and durability are paramount. For example, in power electronics, where components must withstand high currents and voltages, through-hole resistors provide the necessary mechanical strength and thermal dissipation. Additionally, through-hole resistors are favored in prototyping and DIY electronics due to their ease of use and reusability.Impact of Resistor Footprint on PCB ManufacturingThe design of resistor footprints can significantly impact the PCB manufacturing process. For instance, the size and spacing of through-hole resistors influence the drilling process, soldering quality, and overall assembly efficiency. Using standard footprints helps ensure compatibility with automated manufacturing processes, reducing the likelihood of errors and improving yield. Additionally, well-designed footprints facilitate easier inspection and testing during and after assembly, further enhancing the reliability of the final product.Footprint Standards and GuidelinesIndustry standards and guidelines, such as those provided by the IPC (Institute for Printed Circuits), play a vital role in ensuring consistency and reliability in PCB design. These standards offer detailed specifications for through-hole resistor footprints, including pad sizes, hole diameters, and spacing requirements. Adhering to these guidelines is crucial for designers to ensure that their designs are compatible with industry practices and manufacturing capabilities, thereby reducing the risk of costly errors and rework.Challenges in Through-Hole Resistor Footprint DesignDesigning footprints for through-hole resistors presents several challenges, including managing space constraints on the PCB, ensuring adequate thermal management, and maintaining mechanical stability. In high-density designs, it can be challenging to allocate enough space for through-hole components without compromising other aspects of the circuit. Additionally, through-hole resistors must be designed to dissipate heat effectively, which may require careful consideration of pad sizes and PCB layout. Finally, ensuring mechanical stability is critical, especially in applications subject to vibration or mechanical stress.Future Trends in Resistor Footprint DesignAs PCB technology continues to evolve, so too does the design of resistor footprints. One emerging trend is the miniaturization of components, driven by the need for smaller, more compact electronic devices. This trend may lead to the development of smaller through-hole resistor footprints or a shift towards hybrid designs that combine through-hole and surface-mount technologies. Another trend is the increased integration of passive components into multi-layer PCBs, which could impact how footprints are designed and implemented in future electronic devices.Selecting the Right Supplier for High Temperature ResistorsChoosing a reputable supplier is essential for ensuring the quality and reliability of high temperature surface mount resistors. Look for suppliers with a proven track record, strong customer support, and a comprehensive product range. One such supplier is Unikeyic Electronics, known for their commitment to quality and their extensive selection of electronic components. Partnering with a reliable supplier like Unikeyic Electronics can provide the assurance that your resistors will meet the demanding requirements of high temperature applications.ConclusionOptimizing through-hole resistor footprints from prototyping to production is crucial for ensuring the reliability, performance, and manufacturability of electronic circuits. By understanding the unique characteristics of through-hole resistors, following industry standards, and carefully designing custom footprints, designers can overcome common challenges and create robust, high-quality PCB designs. As technology advances, staying informed about emerging trends and innovations will help designers continue to push the boundaries of what is possible in electronics.

Read more >

Unikey collaborates with the century-old American tool brand STANLEY

Recently, Unikey has reached a cooperation agreement with the century-old American tool brand STANLEY, becoming its authorized distributor. Both parties will integrate their advantages in "digital supply chain services and high-quality products" to provide a one-stop hardware tool solution for various industrial users.Currently, STANLEY's hand tools under the STANLEY brand have been officially launched on the official online store of Unikey.A hundred-year-old American brand with a history of producing high-quality artisan toolsSTANLEY is one of the flagship brands under STANLEY Black & Decker, a brand of industrial hand tools as well as artisan-grade power tools. Founded in the United States in 1843, STANLEY has a 180-year brand history and is committed to providing integrated hardware tools and storage equipment solutions for global industrial customers.STANLEY has introduced tens of thousands of new hand tool products to the entire industrial market, with a sales network spanning multiple countries and regions. The products are suitable for various types of industrial users, making it a globally renowned brand with core competitiveness and professionalism in the tool industry. Its flagship products include tape measures, wrenches, wire cutters, tool sets, impact drills, angle grinders, electric hammers, electric screwdrivers, and more.Focused on industrial tool innovation, STANLEY's hot-selling products have been launched in UnikeySTANLEY is passionate about innovation, developing over 200 new products each year and offering more than 10,000 products to customers worldwide. Here are introductions to some of their best-selling products.•Professional Digital Vernier Caliper 37-150-23CMade of high-quality stainless steel with hardened treatment, ensuring high dimensional accuracy. It offers 4 measuring modes including outer diameter, inner diameter, step, and depth. Equipped with a liquid crystal display screen for clearer and more intuitive readings.•Eagle Beak Multipurpose Wire Stripping Pliers 84-319-22With 2-in-1 wire stripping and cutting functions, it can automatically adjust the stripping size according to the wire diameter to avoid damaging the core. Lightweight and easy to carry, with a long service life.•6-piece set of precision metal screwdrivers 66-039-23As a flagship product of STANLEY, the 66-039-23 knife handle is made of chrome vanadium steel with a hardness of HRC52-55. It is packaged in a transparent plastic box, which not only looks aesthetically pleasing but also makes it easy to use.As an integrated supply chain service provider, Unikey empower partners for long-term success.Unikey has been deeply cultivating in the electronic components industry, focusing on the procurement needs of electronic manufacturing enterprises. It digitally constructs a full-chain service system from material supply, warehousing logistics, technical support to production delivery. As of now, the platform has gathered more than 2,000 high-quality suppliers, serving over 130,000 corporate users, Accumulating rich experience in servicing industrial control, automotive electronics, medical electronics, new energy and power, lighting displays, measurement instruments, and equipment, among other industries.By partnering with STANLEY, Unikey will further expand its industrial tools product line, providing industrial customers with a wider range and higher quality of tool options. In the future, Unikey will continue to integrate digital supply chain service capabilities to offer industrial customers better quality and more professional products and services.

Read more >Industries

TrendForce: Server Demand Recovery Expected to Drive Q3 DRAM Prices Up by 8-13%

According to the latest survey by global market research firm TrendForce, the recovery in demand for general servers and the increased production share of HBM by DRAM suppliers have led suppliers to continue raising prices. As a result, the average price of DRAM is expected to continue rising in the third quarter. DRAM prices are projected to increase by 8-13%, with Conventional DRAM seeing a 5-10% increase, slightly lower than the second quarter's growth.TrendForce notes that in the second quarter, buyers became more conservative about restocking, and there was no significant change in inventory levels for both suppliers and buyers. Looking ahead to the third quarter, there is still room for smartphones and CSPs to replenish their inventories as they enter peak production season. This is expected to drive up memory shipments in the third quarter.PC DRAM Prices Expected to Rise by 3-8% in Q3Considering the recovery in demand for general servers and the increased production share of HBM by suppliers, PC DRAM prices are expected to continue their upward trend in the third quarter, with average prices rising by 3-8%. This increase is lower than that of Server DRAM and less than the second quarter's growth due to high PC DRAM inventory levels and unchanged consumer demand.Server DRAM Prices Expected to Rise by 8-13% in Q3General servers will benefit from seasonal stockpiling in the third quarter. TrendForce predicts that this will push the contract prices for DDR5 Server DRAM up by 8-13%. Due to high average inventory levels for DDR4 among buyers, the focus on purchasing has shifted to DDR5, resulting in a higher increase compared to DDR4. The combined average contract price for both is expected to rise by 8-13%.Mobile DRAM Prices Expected to Rise by 3-8% in Q3Since the fourth quarter of last year, consecutive price increases for Mobile DRAM have posed significant challenges for brand profitability. Coupled with sufficient inventory levels, brands have slowed down their bargaining processes as they enter the third quarter, adopting a more passive negotiating stance. However, original manufacturers, aiming to cover profit gaps from previous quarters and anticipating tighter supply and demand next year, maintain an upward pricing attitude. This attitude might be tempered by the buyers' passive negotiation stance and high inventory levels, possibly compressing the third-quarter price increase. TrendForce forecasts a quarterly increase of 3-8%, with LPDDR4(X) showing the smallest gain and potential for further contraction.Graphics DRAM Prices Expected to Rise by 3-8% in Q3Overall demand for Graphics DRAM remains subdued in the third quarter. Price trends will mainly be influenced by other DRAM products. With strong factory engagement in the ongoing price hike cycle, procurement teams are more inclined to accept the proposed price increases by sellers. On the supply side, new GPUs entering the validation stage will lead to increased GDDR7 production. Currently, GDDR7 carries a 20-30% premium over GDDR6. As samples ship in Q3 2024, this will slightly push up the average sales price. Graphics DRAM prices are expected to increase by 3-8%.Consumer DRAM (DDR3 & DDR4) Prices Expected to Rise by 3-8% in Q3The overall Consumer DRAM market still shows an oversupply. However, the three major suppliers' capacity constraints due to HBM production and other suppliers not yet returning to profitability create upward price pressure. Thus, prices are expected to maintain a slight upward trend.Outlook for Q4Looking ahead to the fourth quarter, smartphone and CSPs will continue to have replenishment needs, coupled with an increased production share of HBM by suppliers, supporting continued price increases. As the year-end approaches, both buyers and sellers will formulate procurement strategies based on current supply and demand expectations for 2025. Therefore, TrendForce does not rule out the possibility that buyers will continue to increase inventory to prepare for potential shortages caused by the higher production share of HBM in 2025.

Read more >

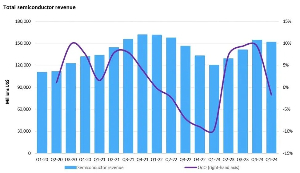

Omdia: Semiconductor Market Experiences Quarterly Decline Due to Weak Demand

In the first quarter of 2024, the semiconductor market experienced approximately a 2% decline, dropping to $151.5 billion. It is common for the first quarter of each year to see a downturn, with market revenue typically decreasing by about 4.4%. This trend is largely attributed to the strong seasonal demand in the fourth quarter that boosts the market. However, in the first quarter of 2024, most segments within the semiconductor market faced downward pressure. Consumer electronics were hit the hardest, seeing a 10.4% drop compared to the fourth quarter of 2023, while the industrial sector declined by 8.5% due to inventory adjustments. Even the automotive sector, which has shown steady growth in recent years, experienced a 5.1% negative growth in the first quarter of 2024. Despite these declines, the robust demand from data centers mitigated the overall drop in the semiconductor market. The data center-related semiconductor segment grew by 3.7%, driven primarily by high demand and high prices for AI-related products, notably NVIDIA GPUs. The shift towards electrification and smart technologies, along with supply chain consolidation triggered by the pandemic, had previously spurred significant growth in the automotive semiconductor market. However, as the overall growth trend slowed, the automotive sector was not immune to the downturn. Starting from the third quarter of 2020, the automotive segment saw revenue growth for 13 consecutive quarters but experienced a minor decline of 0.6% in the fourth quarter of 2023. The decline was more pronounced in the first quarter of 2024, with a 5.1% drop from the previous quarter. This downward trend reflects a broad deceleration in automotive demand. In recent quarters, the growth rate of electric vehicles has slowed down, leading to an adjustment in semiconductor demand. Despite these challenges, the automotive semiconductor market is still expected to maintain long-term growth over the next five years.(Omdia: A Leading Research and Consulting Group Specializing in the Technology Industry)

Read more >